Credit is a funny thing. When you need it the most, you often don’t qualify. When you don’t need it at all, everyone wants to give it to you. Nevertheless, you can’t blame lenders for scrutinizing your creditworthiness before extending you credit: They simply want some sort of guarantee that you won’t take their money and run. And the best indication of creditworthiness is a credit score.

Having a perfect credit score will make you eligible for some of the best interest rates offered. In turn, you could potentially save hundreds of thousands of dollars on loan payments. You’re probably thinking, “Sounds great, but how do I manage to get a perfect credit score?” Well, we’ll show you!

- Part 1: What Is A Credit Score and How Does It Affect You?

- Part 2: Types and Interpretation of Credit Scores

- Part 3: What Determines Your FICO Score?

- Part 4: What Doesn’t Affect Your FICO Score?

- Part 5: Hard Inquiries vs. Soft Inquiries

- Part 6: What Other Factors (Besides Credit Score) Impact Your Interest Rates and Loan Eligibility?

- Part 7: Credit Score Myths Exposed

- Part 8: Credit Q&A

- Part 9: Additional Tips, Tricks and Secrets

- Part 10: Even More Tidbits

- Part 11: Characteristics of FICO High Achievers

- Part 12: Resources

What Is A Credit Score and How Does It Affect You?

Before you can improve your credit score, it’s important to first make sure you have a good understanding of exactly what a credit score is and how it impacts your financial situation. In a nutshell, your credit score is a number from your credit report that represents how likely you are to repay a loan on time. The higher your credit score, the more confident a lender can feel about doing business with you, and thus, the more likely you are to get approved for a line of credit.

Besides using it to decide whether or not to grant you a loan, banks and other lenders use your credit score to determine what interest rates to charge you. In order to mitigate their risk, a lender will typically charge a higher-than-average interest rate to someone with a below-average credit score. Simply put, this means that borrowing money is more expensive for people with a bad credit history.

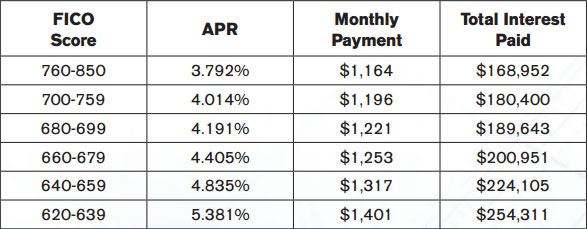

For major loans such as a mortgage, your credit score and resultant interest rates can produce a huge impact on both your monthly payments and on the total amount you have to repay the bank over the years. For example, based on current national averages as of October 2011, on a $250,000 30-year fixed mortgage, a person with an “excellent” credit score will pay about $169,000 in total interest by the time the loan is paid off, whereas someone with a “fair” credit score will pay roughly $254,000 in interest (See Figure 1).

Unfortunately, a bad credit score can have a vicious-circle effect, as high monthly payments make it even more difficult for you to pay your bills on time, ultimately causing your credit score to drop even further.

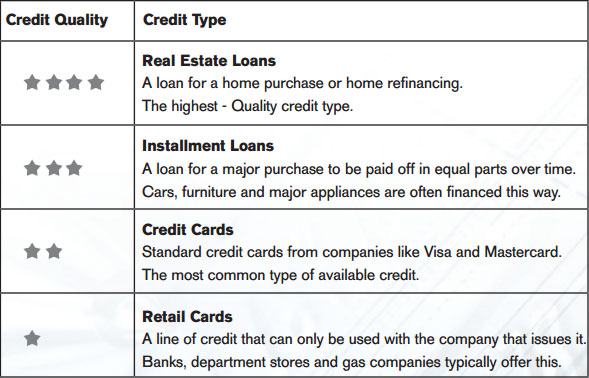

It’s also important to note that your credit score impacts you differently for different types of loans. This means that while your below-average credit score may not be high enough to qualify you for a real estate loan, it may qualify you for lower-quality loans like an installment loan or credit card. Conversely, the type and quality of your existing credits also affects your credit score. But we’ll look more closely at the factors that affect your credit score later on.

Types and Interpretation of Credit Scores

You are probably familiar with the term “FICO score” as it is often used interchangeably with “credit score.” Indeed, the FICO (Fair Isaac Corporation) credit scoring model is the most widely-used of its kind in the United States, and your FICO score is the number most lenders reference as your credit score to determine your creditworthiness.

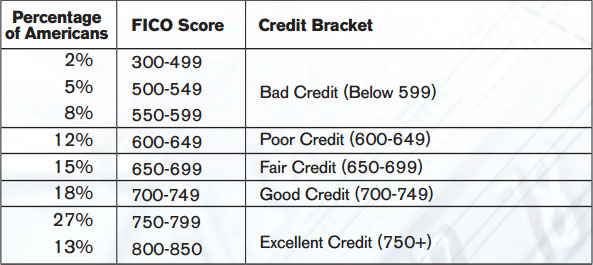

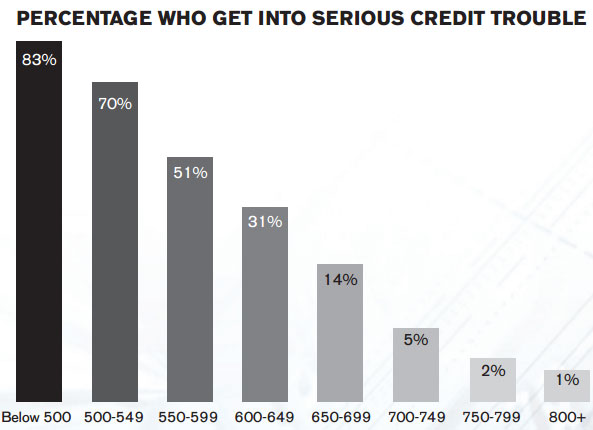

FICO scores range between 300 and 850, with a median score of 723. A score of 599 or lower is typically considered “bad,” whereas a score of 750 or above is considered “excellent.” (See Figure 3). The higher your FICO score, the lower your perceived risk to creditors. For example, a “good” score ranging from 700 to 749 indicates you have a low, five percent risk of developing serious credit problems (See Figure 4).

When it comes to qualifying for a mortgage loan, a FICO score of 620 is typically the cut-off – at least, such is the case since the post-2008 financial collapse. If you do manage to qualify for a mortgage with a sub-620 FICO score, expect to pay very high interest rates.

You actually have three FICO scores, as the three national credit reporting companies (CRCs) that collect the credit report information which determines your credit score – Equifax, Experian and TransUnion – each have their own databases. Depending on the CRC, FICO scores are also marketed under different names, such as Beacon (Equifax) and Empirica (TransUnion). The three CRCs won’t necessarily show identical FICO scores for any individual, since they may all pull from slightly different sets of data. However, credit scores based on the FICO algorithm will rarely deviate significantly for the same individual, unless of course there is incorrect information being reported.

or worse (bankruptcy, account charge-off, etc.) on any credit account over a two-year period.

There are also specialized FICO scoring versions which only lenders see. For example, the auto-enhanced FICO score, which emphasizes auto loan history, is used to determine your auto loan-worthiness and interest rates, while many credit card companies use a bankcard-enhanced FICO score when reviewing a credit card application.

Further complicating the matter, the three major CRCs introduced their own credit scoring system to compete with FICO in 2006. The CRCs’ competing credit scoring model, VantageScore, produces credit score values ranging from 501 to 990. FICO has filed a federal lawsuit against VantageScore, which is ongoing. As a consumer, you don’t really need to worry about your VantageScore as it isn’t widely used by lenders – according to court documents filed for the federal case, VantageScore’s market share is only six percent.

VantageScore and other non-FICO credit scores are also sometimes called “FAKO” or “Fake-O” scores – a derogatory play on FICO. As their nickname implies, you’d be wise not to bother with FAKO scores — and you certainly shouldn’t pay for one. As a consumer, the most meaningful credit score number you need to know is your FICO score provided by one of the authorized CRCs – or even better, the average of your three FICO scores.

What Determines Your FICO Score?

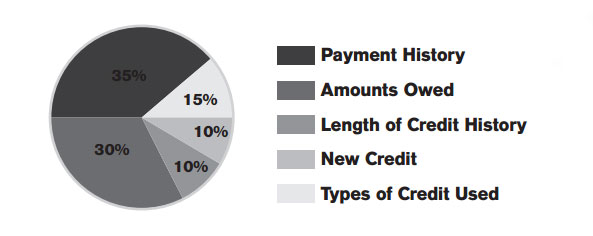

Your FICO score is calculated using various credit-related data from your credit report. The credit information that determines your FICO score can be grouped in to five categories: payment history, credit utilization, length of credit history, new credit, and types of credit used.

Payment History

- Account payment information (includes credit cards, retail cards, finance company accounts, installment loans, mortgage, etc.)

- Existence of derogatory public records (suits, liens, wage garnishments, bankruptcy, judgments, etc.), delinquencies (past due items), and collection items

- Severity and number of delinquencies

- Amounts and recency of delinquencies, adverse public records, and/or collection items

- Number of accounts paid as agreed

Credit Utilization

- Total amounts owing on accounts

- Amounts owing on specific kinds of accounts, including revolving credit accounts and non-mortgage installment loans (owing large amounts on these types of accounts indicates greater risk to lenders)

- Lack of a specific type of balance, such as no recent non-mortgage balance or no recent revolving balances

- Number of accounts with balances

- Proportion of credit lines used (also referred to as your debt-to-limit ratio or debt utilization rate)

- Proportion of installment loan amounts still owing

Length of Credit History

- Time since accounts were opened

- Time since specific types of accounts were opened

- Recency of account activity

New Credit

- Number of recently opened accounts, and proportion of recently opened accounts to total accounts (Type of recently opened account is also important)

- Number and recency of credit card inquiries

- Time since most recent account openings, by type of account

- Positive credit history since past payment issues

Types of Credit Used

- Number, presence and prevalence of various account types (mortgages, consumer finance accounts, installment loans, retail accounts, credit cards, etc.)

- Any recent information on various types of accounts

What Doesn’t Affect Your FICO Score?

- Your capacity to pay your bills Note that while your FICO score reflects your likelihood of timely loan repayment based on your credit history, it does not take into account your capacity or ability to make payments based on your income or holdings.

- Your age

- Your race, color, national origin, gender, religion or marital status Under U.S. law, credit scoring agencies are forbidden to consider these facts, as well as whether or not you’ve ever received public assistance or have exercised a consumer right guaranteed under the Consumer Credit Protection Act.

- Your employment information (such as salary, occupation, title, employer, length of current or past employment, or any other employment history information)

- Child/family support obligations

- Rental agreements

- Where you live

- Certain types of inquiries Your FICO score isn’t affected by “consumer-initiated inquiries,” or personal requests to view your credit report. Other types of requests that don’t affect your FICO score include inquiries from employers, “promotional inquiries” made by lenders to create a “pre-approved” credit offer, and “administrative inquiries” made by lenders to review your account status.

- Any information not present in your credit report

- Any data not proven to be predictive of future credit performance

- Whether or not you have participated in credit counseling of any kind

Hard Inquiries vs. Soft Inquiries

When your credit history information is accessed, this is called an inquiry. Soft and hard inquiries affect your credit score differently, so it’s essential that you know the difference between them.

Soft inquiry

A soft inquiry, or soft pull, is a credit check that doesn’t affect your credit score. When a third party pulls your credit report without the intention of issuing you new credit, this is a soft inquiry. Oftentimes, you, the consumer, is unaware that a soft pull is taking place. Soft pulls may occur when a lender that you currently have a line of credit with checks your credit information to make sure you aren’t defaulting on other accounts.

Lenders also conduct soft pulls in order to make you those pesky, unsolicited, “pre-approved” offers (also called “Firm Offers”) for lines of credit. (If you take them up on the offer, however, the lender will then conduct a hard inquiry before actually loaning you the money). When you pull your own credit report to monitor your credit, this can also be considered a soft inquiry.

Hard inquiry

A hard inquiry is a pull that adversely affects credit score. This kind of credit check occurs when you apply for a new line of credit, such as a credit card, auto loan, student loan or mortgage. While they can be tempting, new credit applications should be avoided unless necessary. For example, applying for a new retail credit card to receive a 10 percent discount on a single purchase can cause you to lose more money – via higher interest rates – in the long run than you gained with the one-time discount.

Hard inquiries remain on your credit report for 2 years. However, they only affect your credit score for one year, and their impact on your score lessens after 6 months. Having some inquiries on your report is not necessarily a big deal, but too many inquiries may give the impression to lenders that you are overextending yourself or trying to take on new debt.

Examples of Hard Inquiries vs. Soft Inquiries

- Applying for an apartment: hard inquiry

- A background check conducted by an employer: soft inquiry

- Applying for a utility or service (cell phone contract, cable, gas & electric, etc.): most likely, a hard inquiry

- Asking for a credit limit increase: This will probably be a soft inquiry – the institution issuing your current line of credit already has a good idea of your creditworthiness.

- Opening a savings account: Can be either a soft pull or a hard pull – be sure to check the bank’s policy before opening an account.

Note: When shopping for auto or mortgage loans, multiple hard inquiries made within a thirty-day period will only count as one hard inquiry on your credit report. Banks understand that you’re shopping around to find the best rates. It is not a good idea, however, to apply for other types of credit, such as credit cards or car loans, in the months prior to applying for a mortgage loan. These hard inquiries will result in a lower credit score when it comes time to make that larger, more substantial purchase.

What Other Factors (Besides Credit Score) Impact Your Interest Rates and Loan Eligibility?

While your credit score is the primary piece of information lenders consider to determine your loan eligibility and/or interest rate, they may also consider other factors. For example, while your credit score doesn’t reflect your salary, assets, or employment history, lenders may take these items into account. In addition to your debt ratio and other data from your credit report, banks and financial institutions may also take into account the following lifestyle factors when calculating your interest rate:

- Length of time at current residence

- Whether you rent or own (owning is preferable)

- Length of employment at your current job (two or more years is preferable)

- Education (college degree may earn you more credit)

- Salary and net worth

Depending on the type of loan you’re applying for, lenders may also consider:

- Down payment amount (for a mortgage loan)

- Business plan (for a small business loan)

- Project feasibility (for business loans)

- Loan-to-value on your home (for mortgage refinance loans)

As with credit scoring agencies, lenders are legally prohibited from taking into account your age, race, gender, national origin or marital status when considering your credit application.

In November 2011, FICO and data provider CoreLogic announced the joint creation of a new type of score for mortgage lenders. This score will incorporate additional consumer information not included in FICO scores, such as payday loans, child support payments and evictions. Status of rent, utility and cellphone payments may also eventually be included in this score. Keep in mind however that it’s still unknown whether or not this new score will be embraced by lenders.

Credit Score Myths Exposed

If you’ve been paying attention, we’ve already dispelled some myths about credit scores. You should now know that not all of your credit scores will be the same (you have three different FICO scores as each credit bureau may pull from different data), that neither your salary nor your level of education affects your credit score (though lenders may consider this information), and that checking your own credit report doesn’t hurt your credit score. Here are a few more credit score myths we thought were in need of debunking.

Myth: I can’t have any negatives on my report.

Truth: If you have a missed payment in the past, or even if you have a far more serious skeleton in your credit closet such as a personal bankruptcy, don’t sweat it too much. In fact, it’s entirely possible to have a score of over 700 even with a bankruptcy on your report. More recent credit data is actually weighted more heavily in calculating your credit score, so the longer it’s been since a past negative event occurred, the less it will affect your score. If you’ve made credit mistakes in the past, just do your best to rectify them and work on re-establishing a good credit history from here on out.

Myth: Opting out of pre-approved offers will benefit my credit score.

Truth: This is a common misconception. As previously mentioned, “soft pulls” that banks conduct to make you pre-approved offers of credit don’t negatively impact your credit score; thus, opting out of these offers won’t benefit your credit score. However, opting out of pre-approved offers will cut down on your junk mail and decrease your risk of identity fraud.

Myth: If I correct an error on a credit file with one credit reporting agency, the correction will be picked up by all of them.

Truth: You might have guessed that this one is false, since you now know that each credit bureau maintains its own separate database. When you find an error on your credit report from one of the three major CCRs, you need to check if it also appears on the credit reports from the other two. You’ll need to individually contact each agency which has an error on file for you; correcting your file with one agency won’t fix your records with the other two.

Myth: Paying or settling a negative account such as a judgment, lien, or charge-off will remove that item from my credit reports.

Truth: Unfortunately, this is also false. However, time does heal all wounds. Most resolved negative events will disappear from your report and stop weighing down your score after seven years, although bankruptcies are an exception – these can linger on your record for up to ten years. Nevertheless, it’s important to settle any negative account standings, since lenders will take outstanding delinquencies into account when considering whether to offer you a new line of credit.

Myth: Asking for lower limits will benefit my credit score.

Truth: Depending on your personal spending behavior, it may be a good idea to request that a lender lower a high limit on your credit card if this will help you stay out of debt. But if you can control your spending, there’s no need to ask for a lower credit limit; this will not benefit your credit score whatsoever. In fact, it could potentially hurt your score by increasing your debt to available credit ratio.

Myth: My credit score is merged with my spouse’s.

Truth: Unlike your assets, your credit score is yours and yours alone and is not affected by husband’s or wife’s score. But even though getting married does not cause your credit information to merge with your spouse’s, your spouse’s credit history can affect your ability to qualify for credit together — for better or for worse. Also, when you open a joint account with a spouse or another person, that information will appear on both of your credit reports.

Myth: A divorce decree will release me from financial responsibility for an account.

Truth: Regardless of what a judge determines in regards to division of credit card payments, mortgage payments and other joint debts between you and your ex, these decisions carry no weight with the creditors, themselves. Therefore, if your ex-spouse misses payments for a car, house or another account that your name is connected to, this can still negatively impact your credit score. To close a line of credit or remove one of your names from a loan you share with your ex, both divorcing parties must contact the creditor or have the other party sign a letter of consent to remove their name. If your credit score is too low, a creditor may not agree to remove the other person from the account, however.

Myth: Receiving credit counseling services will lower my score.

Truth: This is untrue. Seeking debt help from a credit counselor will not, by itself, impact your credit history or score. However, if you sign off on a debt management program, bankruptcy or debt settlement as a result of contracting a credit counselor, it will show up in your credit history. A debt management program (DMP) should not affect your credit score but a bankruptcy or debt settlement involving only partial debt repayment may lower your credit score.

Myth: Using debit or check cards can help rebuild my credit score.

Truth: Debit/check cards have no bearing on your credit score. However, if you overdraw your account using a check card and fail to repay the negative balance, this may harm your credit score if the bank files for collection.

Myth: The higher my credit score, the lower interest rate I’ll get.

Truth: While this is generally true, it is not always the case. Lenders typically use a grading system to calculate interest rates wherein scores falling within a specified range will be assigned a certain grade corresponding to a particular interest rate; a score at the top of this range won’t receive a better rate than a score at the bottom of the range. For example, depending on the lender’s grading system, all scores between 760 and 850 might be graded “A” and receive the lender’s lowest offered interest rate. In such a scenario, raising your score from 760 to 800 would not affect your interest rate.

Myth: My credit score is locked-in for a certain amount of time.

Truth: Actually, your FICO score changes as soon your credit report information changes, and your score is recalculated each time your credit information is accessed. It is entirely possible for your credit score to change in the course of a day.

Myth: As long I pay my bills on time, I don’t need to bother checking my credit report or score.

Truth: Credit reports commonly contain erroneous information ranging from an incorrect date of birth, to missing accounts in good standing, to fraudulent accounts opened in your name. Even if you have good credit habits, it’s important to check your report at least once yearly to make sure the credit information on file for you is accurate.

Myth: I can raise my credit score by hiring a stranger to add me as an authorized user to a credit card account in good standing.

Truth: FICO recently changed its scoring rules to prevent credit repair companies from paying strangers to add clients to their accounts. However, this strategy may still work if the credit card account to which you are added belongs to a spouse, parent, or another close relative.

Myth: My credit report will show a zero balance for any credit cards I pay off before the due date.

Truth: Lenders usually report to the credit bureaus on the statement closing date, not the due date. The closing date appears on your statement and is usually about 20 to 25 days before the due date. Thus, if you want your credit report to show zero balance for a particular card, you need to pay it off before your statement closing date. To play it extra safe when you’re applying for a major loan such as a mortgage, you may want to avoid using your cards altogether for a month in advance so that your debt-to-credit ratio is as low as possible.

Myth: All lenders have the same impact on my credit score.

Truth: Consumer finance accounts are considered a negative by the credit bureaus. Consumer finance companies provide credit to customers who may not qualify for bank or credit union loans, and the credit bureaus know that these customers generally have higher rates of default. Consumer finance companies also charge higher interest rates than traditional lenders, which further increases their clients’ default risk.

Credit Q&A

Question: Should I mix personal and business expenses?

Answer: There’s no easy answer to this question. While credit experts used to advise keeping business and personal expenses separate, this recommendation has changed since the 2009 passage of the Credit CARD Act, which provides certain protections to consumer credit cardholders. Since the CARD Act doesn’t apply to business credit cards, using a personal card for your business expenses can be, in some ways, safer. On the other hand, if you have high business expenses, you may want to keep things separate, since high balances on your credit report can cause you to appear overextended. Then again, there’s a possibility that business expenses can appear on your credit report even if you keep your business and personal accounts separate – some issuers now report business credit card information to the CCRs.

Question: Should I request a lower APR?

Answer: There didn’t used to be any downside to calling your credit card company and asking for a lower interest rate, but current credit issuer practices are such that asking for a lower APR may trigger an account review. If the issuer doesn’t like what it sees in your review, it may actually raise your interest rate and/or reduce your credit limit. Therefore, before asking for a lower APR, check to make sure that your credit report and that specific account are both in good standing.

Question: Is it OK to run up a high balance on a card with no preset spending limit?

Answer: Some credit cards, including American Express cards and some high-end charge cards advertised as having no present spending limits, do not report credit limits to the credit bureaus. Besides AMEX, other examples include Visa Signature and MasterCard World cards (these cards do have monthly limits, although cardholders can exceed them and pay them off in the next bill.) When the FICO scoring system encounters an account with no preset spending limit, it will usually bypass/disregard the card for credit utilization calculation purposes, and your score will not be affected. However, in some cases, FICO scoring formulas may use the account’s highest balance on record, instead of the credit limit, to calculate your credit utilization. In these cases, customers who spend around the same amount every month may appear to be approaching their limit and receive lower scores than they deserve.

Therefore, if you have a card with no preset limit, it’s a good idea to, one month, run up a balance that’s a lot higher than usual. Your credit score may go down that month (depending on whether that particular FICO scoring algorithm bypasses the card or considers your highest balance as your credit limit), but it will improve in the following months. Just make sure you avoid interest charges by paying off the balance in full the following month. Also, do not employ this strategy if you’re planning to apply for a large loan within the next month. Check your credit report to find out which, if any, of your cards don’t report a credit limit.

Question: Is it possible to have too much credit?

Answer: While rare, you may be turned down for new credit if you already have a lot of available credit. Creditors may find it suspicious that you’re applying for more credit, especially if your income level isn’t sufficiently high to justify additional credit availability.

Question: Which FICO score do lenders use?

Answer: It varies with each creditor. Some creditors will use only one of the credit bureaus to access your information. Some may consider the average of your 3 FICO scores, while others may focus on your high, low, or middle score. Others use filters which ignore certain types of items on your credit report, such as past due medical bills. As a result, two creditors will rarely come up with the same score for you, even when pulling the same data from the same credit bureau (As previously mentioned, special credit score calculation “filters” also include auto-enhanced and bankcard-enhanced scores).

Question: How late does a payment need to be before a creditor reports it?

Answer: Creditors typically don’t report a missed payment to the credit bureaus until it’s at least 30 days past due. Legally however, creditors may report a missed payment as soon as it’s one day late.

Question: Where can I find my Experian FICO score?

Answer: Because of the legal battle between FICO and Experian, consumers are no longer able to access their Experian FICO score (however, lenders still can). Instead, Experian.com gives you their “PLUS” Score.

Question: What are FICO scorecards?

Answer: Your FICO score places you in one of ten FICO “scorecards” or ranks of creditworthiness. Within these scorecards, your credit-related behavior is judged against other consumers in a “Bell curve” fashion. It is, therefore, theoretically possible for your credit score to rise or fall due to credit data changes among other people in your same scorecard.

Additional Tips, Tricks and Secrets

In addition to obvious things like paying your bills on time and not racking up huge balances, the following tips can help you build and maintain a healthy credit score.

Apply for credit

Not having enough recent credit history may negatively impact your credit score. If you lack sufficient credit history, you’ll need to apply for credit to improve your score. Before opening a new account, however, it’s important to ask yourself if you’ll be able to use this card on at least a semi-regular basis, and to make sure a lack of credit is the reason your credit score is low – applying for new lines of credit when you already have sufficient credit history can, as previously mentioned, harm your credit.

Don’t apply for more credit cards than you actually need. Also make sure you’re aware of any annual fees associated with a new credit card and that the lender will report your timely payments and credit limit to the three major credit bureaus (not all creditors supply information to the credit bureaus).

Prune your credit

After your first couple years of building credit, it may be a good idea to cancel any cards with low credit limits (less than $1,000). Low credit limits are a sign that lenders can’t trust you to manage too much credit. Additionally, a higher average credit limit for all your accounts results in a higher credit score. Also keep in mind that while it is good to have more than one credit card, you don’t need more than a few. Having more accounts won’t necessarily equate to a better score. While lenders like to see a variety of credit sources, ten credit cards isn’t better than three (although three is better than one).

Get your credit reports and FICO score every year

You are entitled to one free annual credit report from each of the CCRs, although you aren’t entitled to receive your actual credit score for free. However, if you pay a small fee when you get your free credit report, you can also see your FICO score. Take advantage of the opportunity to get your FICO score from at least one of the CCRs, and make sure you also examine each of your three annual credit reports carefully. Be sure to notify the CCRs if there are any errors on your reports.

Dispute inaccuracies on your credit report

If there are blemishes on your credit report that shouldn’t be there, take action to have them removed. Start by sending letters to the lenders themselves and follow-up with letters to all of the credit bureaus that are reporting the erroneous information. Be sure to keep copies of everything you send, and send your letters via certified mail with return receipt requested. This will come in handy if you ever need to prove that the document was received. For sample letters and templates, refer to the resources at the end of this eBook.

Open savings and checking accounts (one each)

Although these don’t directly impact your score, banks like to see that you have these accounts when applying for credit.

Ask for a “goodwill correction”

Lenders will sometimes remove a negative mark from your account if you simply request its removal. Creditors won’t always consent to do this, but it doesn’t hurt to ask. So, make sure you give it a shot, particularly if you have a long-standing account with the creditor and you only have one negative on an otherwise unblemished payment record. FICO does not track changes to your credit history, so if a creditor removes a bad mark from your account today, FICO won’t know it ever existed next time it pulls your file.

Beware of consumer credit scams

There are a number of services that claim they’ll repair your credit or provide other credit related services for “a small fee” – which often adds up to hundreds of dollars. Just about all of these services are misleading and/or overpriced, and some of them are downright fraudulent.

Credit repair services commonly claim that they can remove liens, judgments, or other negatives from your credit record, but such claims are false. Keep in mind that anything a credit repair service can legally do for you, you can also do yourself at little or no cost.

Other common credit-related services that pose risk to uninformed consumers include advance-fee loans, home equity lines of credit, and file segregation – an illegal scheme employed by credit repair companies that helps consumers fraudulently obtain new taxpayer identification numbers from the IRS to hide from creditors. Beware that if you participate in file segregation, you are committing a felony.

Some credit-related services, such as credit monitoring services, may be legitimate, but such services are generally unnecessary.

Besides encouraging you to participate in exploitative and/or illegal actions, consumer credit scams may also collect your information under false pretenses to commit identity theft. If you do decide to pay for any kind of credit service, it is of utmost importance that you do your research to make sure the company is legitimate.

Keep oldest accounts open

Even if you don’t use them anymore, it’s a good idea to keep your oldest credit card accounts open. This will help your credit score by increasing the average age of your accounts, as well as increasing your amount of available credit.

Look into debt consolidation

Consider consolidating your debts if you have difficulty paying your bills on time. Debt consolidation can help lower the total amount of your monthly payments and simplify your debts by consolidating them into one monthly payment. There are various approaches to debt consolidation so make sure you do your due diligence and research the matter thoroughly before taking this step. As with other credit-related services, there are fraudulent debt consolidation companies out there, so be careful.

Keep balances in check

You know that carrying high balances is a no-no. But exactly how low should your balances be? Well, credit experts recommend that your balances not exceed 10-30% of your total credit limit. If you have several cards with balances, pay down the card that’s closest to reaching the credit limit first. Keep in mind however, what’s best for your credit score isn’t always what’s best for you. If you’re carrying a balance on a credit card with a much higher APR than the rest of your cards, it may be in your best interest to pay down the card with the highest APR first.

Choose which payment to miss

If you absolutely must miss a payment, choose carefully. Missing an auto loan or mortgage payment will hurt your credit more than skipping a credit card payment will.

Protect your identity

We can’t stress enough the importance of protecting your identity, as identity theft can have devastating effects on your credit score. The Federal Trade Commission (FTC) recommends the following tips in order to minimize your risk of identity theft:

- Protect your Social Security number

- Treat your trash and mail carefully

- Be on guard when using the Internet

- Select intricate passwords

- Verify sources before sharing information

- Safeguard your purse and wallet

- Store information in secure locations

Even More Tidbits

- You can use Mint.com to manage your budget, track spending and monitor your banking accounts with easy-to-use personal finance tools and calculators.

- You can opt out of receiving “Firm Offers” (pre-approved offers) for credit or insurance.

- The National Foundation for Credit Counseling is a non-profit organization of agencies that provide free or low-cost credit counseling that can help you work with your lenders to come up with a more affordable payment plan.

- At MyFico.com you can access and monitor your FICO score with easy-to-understand charts, graphs and other tools.

- The three major credit bureaus in the United States, Equifax, TransUnion, and Experian, are each required by law to provide consumers with one free credit report per year. These reports can be accessed at AnnualCreditReport.com

- Some of the easiest lines of credit to get approved for include Exxon Mobil, Shell and Citgo gas cards (all of these are offered by Citi). It is also relatively easy to get approved for entry-level Orchard Bank and Capital One cards. A secured credit card is another good option for someone looking to establish or rebuild a credit history.

- The national average credit to debt ratio is about 48% (Available Credit) to 52% (Debt).

- Early repayment of loans does not increase your credit score. To the contrary, an open account in good standing can benefit your score moreso than a closed account! Nevertheless, it may be financially beneficial to pay off a high-interest loan early.

- MyMoney.gov is the U.S. government’s website dedicated to teaching Americans financial education basics.

Characteristics of FICO High Achievers

FICO High Achievers are people who have a FICO score of 760 or higher. The following are characteristics of these High Achievers, as reported by consumers who received the information in their myFICO credit reports.

Payment History:

- FICO High Achievers have an average of 6 accounts currently paid as agreed.

- FICO High Achievers have an average of 12 accounts in good standing.

- About 93% of FICO High Achievers have no missed payments at all. But of those who do, the missed payment happened nearly 4 years ago, on average.

- Very few FICO High Achievers, about 1%, have a 60 days late payment or worse listed on their credit report.

- Virtually no FICO High Achievers have a public record or a collection listed on their credit report.

Credit Utilization:

- FICO High Achievers have an average of 3 credit accounts carrying a balance.

- FICO High Achievers use about 7% of their available credit, on average.

- FICO High Achievers have an average total balance of $5000 on non-mortgage accounts.

- Most FICO High Achievers owe less than $600 on revolving accounts such as credit cards and department store cards.

Length of Credit History:

- FICO High Achievers opened their oldest account 19 years ago, on average.

- FICO High Achievers opened their first revolving account 19 years ago, on average.

- Most FICO High Achievers have an average age of accounts between 6 and 12 years.

New Credit:

- About 72% of FICO High Achievers did not apply for credit in the past year. Of those that did, about 20% applied for credit just once.

- About 54% of FICO High Achievers did not open an account in the past year. Of those that did, about 27% opened just one account.

- FICO High Achievers opened their most recent account 27 months ago, on average.

Types of Credit Used:

- Only 12% of FICO High Achievers have a consumer finance account.

- FICO High Achievers have an average of 4 to 5 credit cards (including open and closed cards, bank cards and department store cards).

- FICO High Achievers use a variety of different types of credit but have only a moderate amount of accounts from the same kind of credit (e.g. multiple credit cards).

Resources

In this section you may find resources including sample letter templates to address credit score problems as well as important credit repair-related contact information.

Free Sample Letters and Templates

Tools for Identity Theft Victims

Credit Related Rules, Acts and Rights Enforced by the FTC

Disputes

TransUnion: Mail | Online

Contact Information

Equifax

P.O. Box 105169

Atlanta, GA 30348

(800) 525-6285

Experian

experian.com

P.O. Box 9554

Allen, TX 75013

(888) 397-3742

TransUnion

P.O. Box 6790

Fullerton, CA 92834

(800) 680-7289

Federal Trade Commission*

600 Pennsylvania Ave. NW

Washington DC 20580

(877) 382-4357

*Note: While they may be able to give you useful advice, the FTC does not resolve individual credit complaints.