How much money would you like to have saved for the holidays? Or your next vacation? Or your emergency fund?

Whatever your goal, the number probably seems overwhelming.

Trying to figure out where several hundred or a few thousand dollars might come from is tough. Instead, break it down. Find ways to set aside just a little bit at a time — you’ll be surprised how quickly you can move toward your goal!

To help you get started with that first step, we’ve put together 21 easy things you can do to help save money this year! If you have any suggestions or tips please email us at contact@lifed.com.

1. Check The Insulation in Your Attic – And Install More If Needed.

If you have an unfinished attic, pop your head up there and take a look around. You should see insulation up there between the beams, and there should be at least six inches of it everywhere (more if you live in the northern part of the United States).

If there’s inadequate insulation up there – or the insulation you have appears to be damaged – install new insulation. Here’s a great guide from the Department of Energy on attic insulation, including specifics on how much you should have depending on where you live. Many states offer financial incentives, up to a 75% refund for instance, to encourage homeowners to better insulate their homes.

2. Negotiate A Better Mortgage Rate With HARP

If you’re a homeowner and you want to save yourself thousands of dollars this year, there’s a program that you might be able to take advantage of called HARP. The Home Affordable Refinance Plan (HARP) could help hundreds of thousands of Americans reduce their monthly payments by as much as $3,500 in their first year. The program was set to expire in 2017 but has been extended to 2018 for the time being. In order to qualify for HARP you’ll need good or excellent credit, so if you don’t have a very good credit rating then this probably isn’t for you. To check if you qualify visit HARP Approvals, and fill out the short quiz (take 2 minutes). If lowering your payments, paying off your mortgage faster, and having an extra $290 a month in HARP savings would help you, then this could be the easiest money savings tip you take.

3. Claim Free Everyday Household Products

Here’s a little tip most homeowners aren’t told about. Chances are you purchase the same household products on a daily/weekly basis. But what if you could get free samples sent to you from these very same manufacturers? Not a lot of people know about it, but you can actually claim free samples from top brands. If you’re looking for a way to get household goods, pet food samples, sweet treats, posters, days out vouchers and much more, we recommend signing up for the Free Samples Guide. Once you provide them with your email address, they’ll let you know when you’re eligible for the latest free samples and how to claim them.

4. Get a Lower Auto Insurance Rate – Pay Less Than $50/Month

Would you like to pay less than $50 per month for your car insurance? Car insurance is mandatory for every driver, but that does not mean you have to pay an excessive premium. If you have no accidents or violations in the past two years, you can probably get a much lower rate than you currently pay and join the 5% of Americans who figured out how to pay less than $50 a month! In the past, you’d have to shop around and call several companies to compare rates. Today, you can use a website tool that shows you comparable rates from top companies, letting you make the clear choice. See how low you can get your rate and tell your friends!

5. Never Pay For Home Repairs Again

Many homeowners don’t have the extra cash to shell out for repairs when something in the house breaks. You most likely have homeowners insurance right? But what about if your washing machine of 10 years breaks down? Or your dryer just stops working one day? Homeowner insurance won’t cover those repairs. That’s why getting setup with a Home Warranty Program can actually end up saving you a lot of money in the long run. It will cover any unexpected repairs to your appliances, plumbing, water heaters, heating and other electrical systems. They also will replace anything that they can’t fix. Make sure you shop around for rates on a home warranty program – this website will give you quotes that you can then choose from. A home warranty program should be a minor cost that can end up saving you major money.

6. Lower The Temperature on Your Water Heater Down To 120 Degrees Fahrenheit (55 Degrees Celsius)

This is the optimum temperature for your water heater. Most people don’t use water hotter than 120 degrees — indeed, water hotter than that can scald you or a child — and thus the energy needed to keep the water above 120 degrees isn’t used effectively. Lower the temperature, save money on your energy bill, and you’ll never skip a beat.

7. Reduce Your Electricity Bill With Solar Panels

For Homeowners, rising monthly electricity costs can make you feel like you’re always living paycheck to paycheck. The good news is that now more than ever there are subsidies to install solar panels. That means if you live in a sunny part of the United States, you may be able to qualify for a free installation, and it will significantly reduce your electricity costs in a matter of weeks. In fact, some Americans have saved as much as $183 per month on their energy bills. If you’re not happy with solar panels, you can always wait until the new Tesla home Powerwall is ready and purchase that. If you’d like to get a quote on solar panels in your area – you can visit Home Solar Installation and get an idea of how much money you can save by making the switch.

8. Save Money on New Windows

Many people opt to replace old drafty windows at home with new energy-efficient ones. Replacing old windows can also lower your utility bill by 40% per month and increase your home’s curb appeal. You may also qualify to save $100s in seasonal discounts from manufacturers like Pella, Champion, and Andersen. Make sure you find the best price you can get by visiting Modernize Windows to compare pricing from local professionals.

9. Consolidate All Your Existing Debt Into One Simple Payment

Debt consolidation is the process of combining all your unsecured debts into a single monthly payment. Generally this allows for much lower payments on a monthly basis than the sum total of the separate debts – making life a lot more manageable. The likelihood in these circumstances of reducing interest rates is very high, and there are many firms out there who will walk you through the process making it simple and painless. If you have more than $10,000 in debt, then this is something you should do right away. You can get the best quote to consolidate all your unsecured debt by clicking the link below.

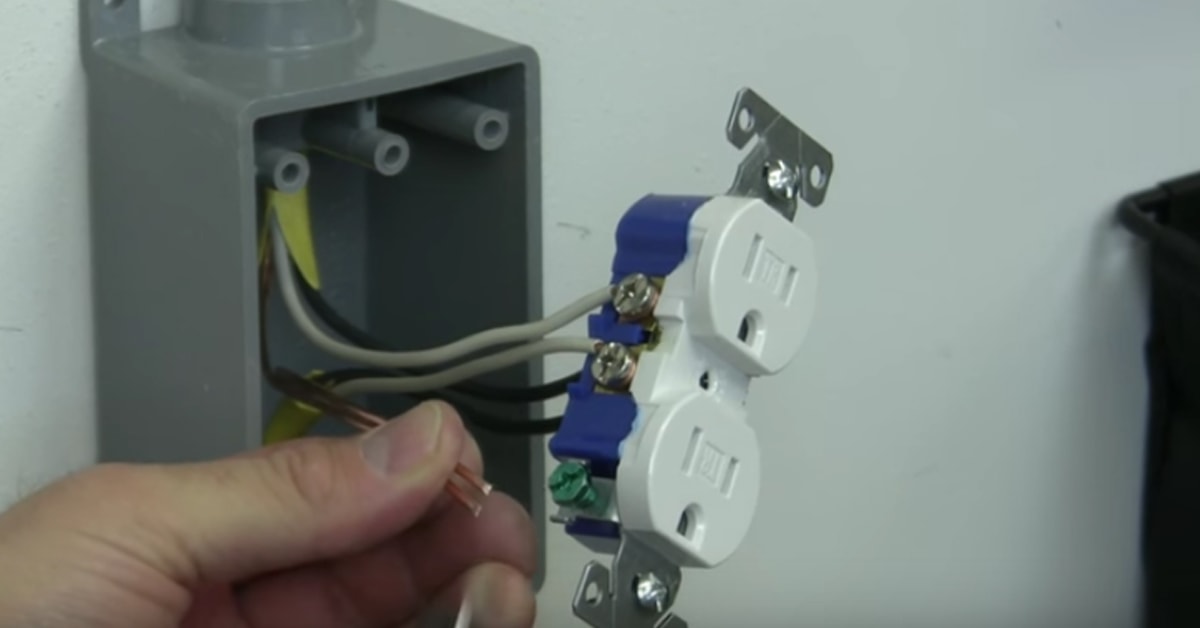

10. Child Proof Your Outlets – Even If You Don’t Have Kids

My first home which was built in 1999 had this next problem. The inside outlets located on the exterior walls were like mini vacuums when it came to transferring air from the inside to the outside.

If you have an older home or a poorly constructed home you’ve probably got the same problem.

Electrical outlet boxes typically don’t have any insulation behind them, creating what is basically a hole in your wall. On a windy day take some incense or a match and put it in front of an outlet (one without a plug in it of course) and see if you can see air movement. In my situation I noticed this during the winter when I felt a cold breeze coming through the outlets.

The simple solution? Install socket sealers to improve energy efficiency. All you have to do is remove your outlet cover with a screwdriver, put on the outlet sealer, and put the cover back on. Easy!

The second step is to put in those plastic child-proof outlet plugs.

11. Get Paid To Take Online Surveys – Make More Money Every Week

What if you could get paid a little bit of extra pocket money just for taking a few online surveys? Would you do it? There are several new websites that allow you to do just that. You provide them with a bit of information about yourself and they’ll match you up with to surveys that you can complete for big brands. You then earn rewards and virtual points that you can redeem for Paypal or e-Giftcards. You won’t make a ton of money doing this, but it could help pay for a few things every month and it’s easy to do.Lunch breaks, bus rides, and nights are opportunities to take surveys and earn spending money or build your stash of savings.

12. Install A Home Alarm System

Did you know that homes without security systems are 2.5 times more likely to be targeted by burglars and intruders? But installing a home alarm system isn’t just to stop burglars and intruders, it can also save you big money year after year. A house alarm will save you money on your homeowners insurance policy (which is generally mandatory if you own a home). In fact, on average installing a home alarm system will give homeowners a 10-20% discount on their insurance by having a high functioning home alarm system installed. The good news is that these home alarm companies are pretty desperate for customers at the moment so you can get a good deal. For instance, one of the best alarm system companies – ADT is currently offering over $800 in savings if you just pay the installation fee. That means you basically get a free alarm system for over a year, just by paying a $99 fee.

13. Cut The Cord on Cable Forever

Millions of Americans are completely cutting the cord on their monthly cable costs, allowing them to save $100+ per month in unnecessary fees. Many of them are switching to Netflix or Amazon Prime Video subscriptions, but there are also other ways you can get cable channels without needing to pay a monthly fee. All your local news, weather, sitcoms, cooking shows, kid’s shows, sports and thousands of movies are available for free with a Digital antenna. In fact, most broadcast stations offer additional regional programming, absolutely free. The SkyLink digital antenna simply attaches to your current TV’s antenna jack (all TV’s have them), and then you get to enjoy Free Broadcast TV. It supports 1080p HDTV and has up to 30 miles of range, so it’s nothing like the “rabbit ears” people used in the past. If you find you’re not watching as much television as you used to, this could be the perfect solution for you and can save you a lot of money every month.

14. Save on Life Insurance

Unfortunately, as our age increases so do our premiums for life insurance. In fact, typically the premium amount rises 8-10% for every year of age. For senior citizens, rising life insurance policy costs can add up significantly. Many senior citizens also have a hard time qualifying for a new policy once they reach a certain age. The best way to get the cheapest life insurance policy possible is to compare quotes from multiple carriers in much the same way you would do with car insurance, or cell phone plans. Luckily, there’s a new website called LifeInsurance.net that will automatically use your information to find you the best life insurance policy for your needs at much lower prices.

15. Get Money Back Instantly For Stuff You’ve Already Bought

Do you love getting refunds? How cool would it be to get money back on stuff you’ve already bought without having to do a thing? Paribus is an app that lets you find out if stores you’ve shopped at online owe you a refund. It’s free to sign up. Paribus connects to your email account and checks your receipts. If they find out a retailer has dropped their price they file a price adjustment claim for you automatically. Try out Paribus.

Paribus works with a huge number of merchants that you probably already shop at, including Walmart, Amazon, Costco, Best Buy, Target, Apple, Kohl’s, and more!

16. FIXD – Save Money on Car Repairs!

Have you ever gone to an auto repair shop for an oil change, only to have the mechanic say you need a new transmission? Or has the mysterious “check engine” light come on, and next thing you know the mechanic has a list of expensive engine parts that need replacing? Unfortunately, mechanics know taking advantage of people is easy, given their lack of knowledge about car maintenance needs.

But there’s a new device you can carry with you in your car to tell you exactly what’s wrong with it. If you own a car built after 1996 then you can use this brilliant new device called Fixd to instantly diagnose any car problems. This means the next time your “Check Engine Light” happens to come on, you’ll know exactly what the issue is and the Mechanics won’t be able to lie to you! In the United States alone, this product did over $50,000,000 in sales in 2017.

17. Claim Your Free 72 Hour Survival Food Kit

This special promotion is currently available to help anyone prepare for disasters. With floods, tornadoes, and other natural disasters on the rise, this company decided that they wanted every one to have access to their survival food kits. That’s why they currently have a special promotion for American citizens to get a free 72 hour survival food kit (just pay the S&H fee).

They source most of their raw ingredients from the “fresh produce” category – picture the delicious veggies you find in season at your local farmer’s market. No harmful chemicals, no GMOs and no added MSG.

They also combine their top-quality ingredients using prize-winning recipes so that they’re loaded with flavor. Many of their recipes have won independent taste tests. We recommend giving them a try and taking advantage of this special offer.

18. Automate Your Thermostat or Use A Post-It Note

In my first home, I would manually turn up the thermostat as I walked out the door to work, and I would manually adjust it down when I came home in the evening. Last year I replaced all of the thermostats in my house with the Nest learning thermostat. It learns your schedule to keep your home comfortable when you are home. Nests’ are pricey, but according to the Nest website, some energy companies will give you a $249 Nest Thermostat free when you sign up for some of their plans. Definitely check with your utility provider to see what you can get from them. If you can’t get a free or discounted smart thermostat from your utility provider, you can go the manual route like I used to. Go get a sticky note, and put it on the door you take to leave your home. Write a reminder to change the thermostat as you walk out the door. Simple and free.

19. Upgrade Your HVAC System And Save On Money and Energy

Old heating, ventilation and air systems suck energy and finances and after several years just don’t get the job done like they used to… The goal of a good HVAC system is to provide thermal comfort and good, healthy indoor air quality. There are literally hundreds of companies out there clamoring for your business and you can get quotes from up to four pre-screened, licensed, & insured contractors.

20. Save on Medical Costs

Healthcare is an essential part of life, and the costs of doctors and the right treatments add up more and more as we age. Most people need to take some type of medication at some point in their life, so it’s only right that you should be getting the most out of your medical insurance.

By working with the best insurance company for your needs you can be sure to have the best coverage for the cheapest prices.

Some insurers will send out a discount card that you can show when paying for prescriptions. Just remember to check with your local pharmacy to see what discounts are available to you, because discounts might change depending on location.

Many people may be able to get extra benefits and don’t even know they’re available. You can also check if you are eligible to get vision, dental, hearing or prescription drug coverage included in your plan.

21. Home Organizing

You could easily do home organizing for people. If you’re a tidy and organized person yourself, and you’re good at organizing spaces, why not offer your services to people around you? You’d be surprised at how many people, even on your own social media feed, might take you up on doing something like this.

Again, a site like Care.com also helps to connect home organizers with people looking for this type of service. It all depends on whether you want to go through a professional company or pitch it yourself to people that are already in your personal or business network.