How much money would you like to have saved for the holidays? Or your next vacation? Or your emergency fund?

Whatever your goal, the number probably seems overwhelming.

Trying to figure out where several hundred or a few thousand dollars might come from is tough. Instead, break it down. Find ways to set aside just a little bit at a time — you’ll be surprised how quickly you can move toward your goal!

To help you get started with that first step, we’ve put together 21 easy things you can do to help save money this fall & winter! If you have any suggestions or tips please email us at contact@lifed.com.

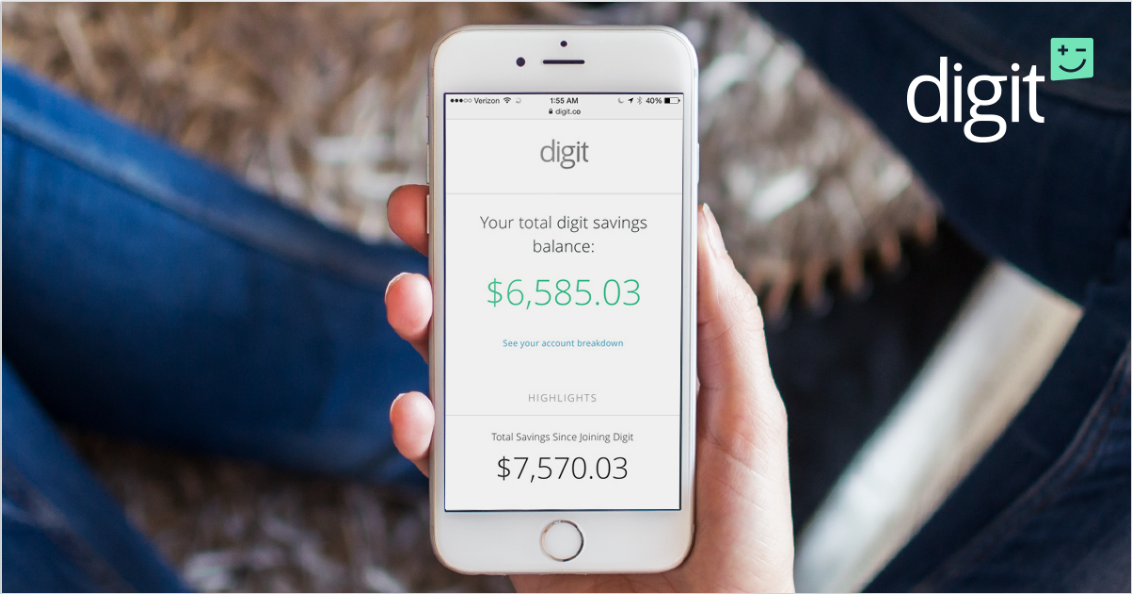

1. Sign Up With Digit – Save Money Without Realizing It

If you’ve ever tried to create a savings habit, you know how difficult it is to get started. After opening a separate savings account, you begin to put as much money as possible into it each month. But then, after a few weeks, an emergency inevitably happens and you need to use the money. Now you’re back to square one. This is where a service like Digit can help!

Digit is a microsavings platform designed to help you save small bits of money over time. You won’t get rich off the money you save with this service, but it does initiate that first step toward creating a savings habit and building wealth. It’s an easy way to save money without doing anything.

2. Become A DoorDash Driver – “It’s A Great Side Hustle”

How would it feel to make extra money while driving and meeting new people? Many millennials are taking advantage of the rise in meal delivery apps to make extra money, while some even turning it into a full time hobby. It not only allows them to earn some cash, but also enjoy driving and meeting people at the same time.

We recommend DoorDash as it is one of the top delivery apps out there. Drivers expressed they enjoy the flexibility the service provides, allowing them to make money around their own schedule when they want. The app also allow users to tip on top of their order, meaning more cash for you. Starting is easy too: just sign up, have a valid driver’s license and start earning.

3. Consolidate All Your Existing Debt Into One Simple Payment

Let’s face it, whether it’s student loans or credit card debt, more Americans than ever are now in a mountain of debt. If you’re one of these people, then you need to find a way to reduce the interest rates you’re paying on your debt, and that’s where debt consolidation comes in. Debt consolidation is the process of combining all your unsecured debts into a single monthly payment. Generally this allows for much lower payments on a monthly basis than the sum total of the separate debts – making life a lot more manageable. The likelihood in these circumstances of reducing interest rates is very high, and there are many firms out there who will walk you through the process making it simple and painless. If you have more than $10,000 in debt, then this is something you should do right away. You can get the best quote to consolidate all your unsecured debt by clicking the link below.

4. Claim Free Everyday Household Products

Here’s a little tip most people aren’t told about. Chances are you purchase the same household products on a daily/weekly basis. But what if you could get free samples sent to you from these very same manufacturers? Not a lot of people know about it, but you can actually claim free samples from top brands. If you’re looking for a way to get household goods, pet food samples, sweet treats, posters, days out vouchers and much more, we recommend signing up for the Free Samples Guide. Once you provide them with your email address, they’ll let you know when you’re eligible for the latest free samples and how to claim them.

5. Get a Lower Auto Insurance Rate – Pay Less Than $50/Month

Would you like to pay less than $50 per month for your car insurance? Car insurance is mandatory for every driver, but that does not mean you have to pay crazy high premiums. If you have no accidents or violations in the past two years, you can probably get a much lower rate than you currently pay and join the 5% of Americans who figured out how to pay less than $50 a month! In the past, you’d have to shop around and call several companies to compare rates. Today, you can use a website tool that shows you comparable rates from top companies, letting you make the clear choice. See how low you can get your rate and tell your friends!

6. Butcher Box – End Factory Farming And Pay 37% Less For Grass Fed Meats

Here’s an interesting way you can save money and do your part to also end factory farming forever (by voting with your wallet). You’ve probably seen the videos of factory farms and if you felt anything like me watching them then you knew you needed to make a change. Have you ever had grass fed beef or heritage breed pork?

Although we are pretty big carnivores in my house, I’d always assumed that buying high quality grass fed meat would be too expensive. But I changed my mind after I took a look at the meat delivery service called Butcher Box. Their prices are reasonable and are actually 37% cheaper than buying organic meats in the supermarket. Our box arrived well packed and protected. The meat was vacuum sealed and hard as a rock with 11 pounds of dry ice to keep everything frozen. Butcher Box is a subscription service that delivers amazing, humanely raised grass-fed beef, heritage breed pork and organic pastured chicken right to your doorstep. You can also get other meat-lovers’ delights like steaks, bacon and breakfast sausage. They are currently offering free heritage bacon with every order!

7. Get Paid To Take Online Surveys – Make More Money Every Week

What if you could get paid a little bit of extra pocket money just for taking a few online surveys? Would you do it? There are several new websites that allow you to do just that. You provide them with a bit of information about yourself and they’ll match you up with to surveys that you can complete for big brands. You then earn rewards and virtual points that you can redeem for Paypal or e-Giftcards. You won’t make a ton of money doing this, but it could help pay for a few things every month and it’s really easy to do. Lunch breaks, bus rides, and nights are opportunities to take surveys and earn spending money or build your stash of savings.

8. Cut The Cord on Cable Forever

Millions of Americans are completely cutting the cord on their monthly cable costs, allowing them to save $100+ per month in unnecessary fees. Many of them are switching to Netflix or Amazon Prime Video subscriptions, but there are also other ways you can get cable channels without needing to pay a monthly fee. All your local news, weather, sitcoms, cooking shows, kid’s shows, sports and thousands of movies are available for free with a Digital antenna. In fact, most broadcast stations offer additional regional programming, absolutely free. The LiveWave digital antenna simply attaches to your current TV’s antenna jack (all TV’s have them), and then you get to enjoy Free Broadcast TV. It supports 1080p HDTV and has up to 30 miles of range, so it’s nothing like the “rabbit ears” people used in the past. If you find you’re not watching as much television as you used to, this could be the perfect solution for you and can save you a lot of money every month.

9. Get Money Back Instantly For Stuff You’ve Already Bought

Do you love getting refunds? How cool would it be to get money back on stuff you’ve already bought without having to do a thing? Paribus is an app that lets you find out if stores you’ve shopped at online owe you a refund. It’s free to sign up. Paribus connects to your email account and checks your receipts. If they find out a retailer has dropped their price they file a price adjustment claim for you automatically. Try out Paribus.

Paribus works with a huge number of merchants that you probably already shop at, including Walmart, Amazon, Costco, Best Buy, Target, Apple, Kohl’s, and more!

10. Federal Rent Checks – Claim $1,795 Or More Every Month

Here’s something most people have never heard of. Apparently, thousands of Americans are now signing up for “Federal Rent Checks”, these are checks that make social security and every other government program look insignificant. Under an IRS directive, you may be eligible to collect these Federal Rent Checks. In a special video presentation, Financial Expert Brad Thomas, one of President Trump’s top campaign advisors reveals how anyone can start collecting these checks. You can learn more about “Federal Rent Checks” by clicking here.

11. FIXD – Genius Device Saves Thousands of Dollars On Unnecessary Car Repairs

Have you ever gone to an auto repair shop for an oil change, only to have the mechanic say you need a new transmission? Or has the mysterious “check engine” light come on, and next thing you know the mechanic has a list of expensive engine parts that need replacing? Unfortunately, many mechanics know taking advantage of people is easy given their lack of knowledge about car maintenance needs.

But there’s a new device you simply plug into your car that tells you exactly what’s wrong with it (and gives you an estimated repair cost). If you own a car built after 1996 then you can use this brilliant new device called FIXD to instantly diagnose any car problems. This means the next time your “Check Engine Light” happens to come on, you’ll know exactly what the issue is and the mechanics won’t be able to lie to you!

All you have to do is plug FIXD into your onboard diagnostics port (which is usually located under the dash below the steering wheel) and then download the free FIXD app on your smartphone (Apple or Android). The app will let you know if there are any specific issues with your car in plain and easy to understand language. Not only that, but it will also provide you with an estimate of the cost to fix any issues and will let you know what the consequences are if you continue to drive with the problem. You also have the ability to reset your check engine light in the app with the click of a button.

Click Here For Our Full FIXD Review And To Check For A Special Promotion.

12. Special Program Pays Homeowners Up To $100,000 (You Must Qualify)

This amazing program can help qualified homeowners pay for home improvements and renovations, but the banks have been keeping this quiet!

When homeowners visit the 100k Survey website they may be surprised to find out that they qualify for a cash-out payment that could help make home improvements, take a vacation, pay off debts, and more.

This brilliant program can provide up to $100,000 to qualified homeowners (if you qualify). Most homeowners use this cash for home remodeling and repairs but you can use it however you want.).

As far as we are aware, deadlines for these programs haven’t yet been announced, but if transforming your home, paying off debts, or even just taking the cash for a vacation or new car would help you, it’s smart to act now.

Remember, these are free programs and there is absolutely NO COST to see if you are eligible. Click here to check if you qualify and find out how much you can claim. It’s an easy way to put cash back in your pocket!

13. Claim Your Free 72 Hour Survival Food Kit

This special promotion is currently available to Americans on a first come first serve basis. With floods, tornadoes, and other natural disasters on the rise, Food4Patriots decided that they wanted as many Americans as possible to have access to their survival food kits. That’s why they currently have a special promotion for American citizens to get a free 72 hour survival food kit (just pay the S&H fee).

They also combine their top-quality ingredients using prize-winning recipes so that they’re loaded with flavor. Many of their recipes have won independent taste tests. We recommend giving them a try and taking advantage of this special offer.

14. Slash Your Monthly Mortgage Payments By Doing This

If you’re a homeowner and you want to save yourself thousands of dollars this year, there are programs that you might be able to take advantage of. This mortgage reduction plan is helping hundreds of thousands of Americans reduce their monthly payments by as much as $3,120 in their first year. In order to qualify for this program you’ll need good credit, so if you don’t have a good credit rating then this probably isn’t for you. If lowering your payments, paying off your mortgage faster, and having an extra $290 a month in savings would help you, then this could be the easiest money savings tip you take.

15. Braces Too Expensive? Try SmileLove And Save 75%

If you avoid cheesin’ in your photos because you don’t love your smile, you’re not alone. There’s 90 million other Americans out there who feel the same way. With the price of braces costing more than your first-born, it’s no wonder that straightening your teeth hasn’t been a higher priority. That’s why so many Americans are now turning to SmileLove, as their treatment costs 75% less than traditional braces, and their aligners are clear and removable AND you can do everything in the comfort of your own home. Stay in your sweats, treat yourself and start using SmileLove to save money on getting that straight smile you always wanted. They’ll also give you $50 off your first impression kit for using the link below.

16. Child Proof Your Outlets – Even If You Don’t Have Kids

My first home which was built in 1999 had this next problem. The inside outlets located on the exterior walls were like mini vacuums when it came to transferring air from the inside to the outside.

If you have an older home or a poorly constructed home you’ve probably got the same problem.

Electrical outlet boxes typically don’t have any insulation behind them, creating what is basically a hole in your wall. On a windy day take some incense or a match and put it in front of an outlet (one without a plug in it of course) and see if you can see air movement. In my situation I noticed this during the winter when I felt a cold breeze coming through the outlets.

The simple solution? Install socket sealers to improve energy efficiency. All you have to do is remove your outlet cover with a screwdriver, put on the outlet sealer, and put the cover back on. Easy!

The second step is to put in those plastic child-proof outlet plugs.

17. HeatBuddy – Heat A Room In Minutes (And Save $100’s)

Days are getting shorter, the weather is getting colder. Heat up an entire room in less than 20 minutes. After a long and hot summer, you need to be ready for a cold winter. Don’t be caught in the middle of a snowstorm, bundled up with 3 layers of clothing wishing you had your own HeatBuddy. Portable and with adjustable settings, HeatBuddy helps you and your family make life easier one room at a time! This is a no brainer when it comes to saving money on your heating costs this winter… rather than leaving your heating on all day and all night, use the HeatBuddy to heat up your rooms fast and efficiently. Overall this could end up saving you a lot of money every winter.

18. Pest Defender: Rid Your Home Of Bugs And Mice (Chemical Free, Don’t Pay Exterminators)

We decided to throw in a product that we’ve seen many homeowners purchasing for the winter months. Mice, rats, bugs, and other pests seek shelter and warmth during the cold winter months and who wants to deal with all that? Plus there’s the cost of paying an exterminator (on average it costs $300+). That’s why we’re telling people about this genius gadget called the Pest Defender. The Pest Defender device emits ultrasonic waves that are silent to humans and pets, but make your home unbearable to insects and vermin. Plug this device into your wall socket and you’ll be rid of bugs and mice forever.

Pest Defender is the simple, chemical-free, easy-to-use, and cost effective solution if you have mice or bugs in your home. It’s also a great way to prevent those nasty rodents and bugs from ever stepping foot in your house in the first place. This one time purchase might end up saving you thousands in exterminator fees.

19. Rent Out A Spare Room on AirBNB

AirBnB can be a terrific platform for renting out a spare room. You can make some good money, especially if you live in a tourist destination. If you don’t mind the neighbours, then this is definitely an option. You can crash with friends and family and rent out your entire house if you’re really desperate for some extra money.

20. Invest In The Booming Marijuana Industry Before 2020

If there’s one thing millennials should know, it’s that marijuana stocks are set to explode as the United States moves more and more towards legalisation. As medical marijuana begins legalising in all 50 states, an expected 4,067% industry boom will transform the average American’s savings into early retirement nest eggs. If you have any money you can set aside to get in on this next big industry, now is the time to act. Looking to learn more about the growing marijuana industry and which stocks to invest in? Watch this video now.

21. Here’s How To Raise Your Credit Score 150+ Points

Everyone who’s saddled with bad credit has a unique story.

A man burdened with $6,000 in unpaid bills. A couple recovering from job loss and foreclosure. A woman who fell behind on payments while living abroad. A single mom with a terminally ill child. A young woman with so much debt she couldn’t even get a credit card.

One of the toughest parts about paying down debt and fixing your credit score is knowing where to begin, and that’s where The Credit People can help. Once you sign up with them, they’ll take care of everything. You’ll get access to an online dashboard that provides you with a detailed breakout of your current credit and all three of your credit scores. They will then put a live credit expert to work on your case who will aggressively challenge and remove questionable items from your credit. You’ll see your credit score start increasing in as little as a month.