There are many special discounts that are available to seniors. Retirees are offered discounts at most retailers, restaurants, parks, on public transport and at hotels. However, you won’t get these discounts unless YOU ASK for them in person or over the phone.

But what about senior discounts online? We realized that seniors had no way of knowing about the online discounts available to them and compiled a list of the 22 best discounts available. Not only can you read about them here, you can click the links provided if you want to take advantage of these special discounts

1. Get Up to $4,264/year Off Your Mortgage

If you’re a homeowner born before 1985 and you want to save yourself thousands of dollars this year, there’s a government program that you might be able to take advantage of called HARP. The Home Affordable Refinance Plan (HARP) is helping hundreds of thousands of Americans reduce their monthly payments by as much as $3,500 in their first year. The program was set to expire in 2017, but has been recently extended through 2018. In order to qualify for HARP you’ll need good credit, so if you don’t have a good credit rating then this probably isn’t for you. If lowering your payments, paying off your mortgage faster, and having an extra $290 a month in HARP savings would help you, then this could be the easiest money savings tip you take.

2. Get a Lower Auto Insurance Rate

You might think you’re already paying a low auto insurance rate, but recent research shows that only 5% of Americans over the age of 55 are paying less than $50 per month for car insurance. If you’re currently paying more than $50 per month, and have had no accidents or tickets in the past two years, you can probably secure a much lower car insurance rate. The best way to do that is to compare quotes from multiple insurers – let them compete for your business. In fact, there’s a new website that allows you to do just that – it’s called Zebra Auto Savings. Once you fill out the form on their website they’ll provide you with multiple quotes you can choose from. If you’re still not satisfied, you can always call up the major car insurance companies and let them know you’re looking for better offers and that you’re a senior citizen.

3. Cruise Deals

Carnival Cruises, Royal Caribbean, Costa Cruises, Cruise Direct, there are hundreds of amazing cruises at great prices to be found online.

Is there any better way to celebrate life than to venture out at sea? Cruises are wonderful with their all-inclusive travel options where you get to sit back, have a drink or two for free, soak up the midday sun and enjoy some high-class cuisine along with various live music performances.

Cruise lines offer a huge variety of discounts for senior citizens, and this includes some of the most well-known companies like Carnival Cruises and Royal Caribbean, offering exclusive deals to citizens over the age of 55. You will be able to get a cruise deal anywhere in the world, be it the Caribbean or even the icy Alaska. Keep in mind that not all cruises have discounts, so it is best to check with the specific cruise company.

4. Consolidate All Your Existing Debt Into One Simple Payment

Stepping into retirement can be pretty daunting. Doing it with existing unsecured debts can make it even more of a challenge. Debt Settlement allows you to combine all your unsecured debts into a single monthly payment. Generally this allows for much lower payments on a monthly basis than the sum total of the separate debts – making life a lot more manageable. There are many firms out there who will walk you through the process making it simple and painless. If you have more than $20,000 in debt then this is something you should do right away, especially if you have credit card debt. You can get the best quote to settle all your unsecured debt by clicking the link below.

5. Never Pay For Home Repairs Out-of-Pocket Again

Many people simply don’t have enough money lying around to pay for expensive home repairs. Your home insurance won’t cover your washing machine or AC breaking. What if your heater breaks when you need it the most? How many people have hundreds, or in some cases thousands, of expendable dollars to spend at a moment’s notice for a big repair?

This is why many homeowners are getting this new Home Warranty Program and they’re ending up saving thousands in the long run. ACs, electrical heaters, appliances, roofing repairs – they’re all covered! If there’s something they can’t fix they will just replace it.

6. Save on Medical Costs

Healthcare is an essential part of human life, and the costs of doctors and the right treatments add up more and more as we age. Most retirees need to take some type of medication, so it’s only right that you should be getting the most out of your medical insurance.

By working with the best insurance company for your needs you can be sure to have the best coverage for the cheapest prices.

Some insurers will send seniors a discount card that you can show when paying for prescriptions. Just remember to check with your local pharmacy to see what discounts are available to you, because discounts might change depending on location.

Many seniors may be able to get extra benefits and don’t even know they’re available. You can also check if you are eligible to get vision, dental, hearing or prescription drug coverage included in your plan.

7. Save on Life Insurance

Unfortunately, as our age increases so do our premiums for life insurance. In fact, typically the premium amount rises 8-10% for every year of age. For senior citizens, rising life insurance policy costs can add up significantly.

Many senior citizens also have a hard time qualifying for a new policy once they reach a certain age. The best way to get the cheapest life insurance policy possible is to compare quotes from multiple carriers the same way you would do with car insurance or cell phone plans. National Family is a great resource to use for just that. They will automatically use your information to find you the best life insurance policy for your needs at much lower prices.

8. Save on Health Insurance

Many seniors are concerned about the rising cost of healthcare and the limitations of their existing health coverage. While some employees may offer health insurance for their retirees, many do not and the coverage they provide is limited. Luckily, seniors have more options for obtaining health insurance than ever before and can compare dozens of affordable policies that offer top-notch coverage.

Thanks to the Affordable Care Act (ACA), insurance companies can no longer deny insurance or increase premiums because of pre-existing conditions which allows senior citizens to compare affordable policies without worrying about their medical history. HealthInsurance.net is another company which automatically matches you with the top Health Insurance policies based on your information, allowing you to save money and feel comfortable with your level of coverage.

9. ADT Offers Seniors An $850+ Discount On A Home Security System

This money saving idea is also for senior homeowners, so if you’re a renter you can skip this one. Did you know that homes without security systems are 2.5 times more likely to be targeted by burglars and intruders? But installing a home alarm system isn’t just to stop burglars and intruders, it can also save you big money year after year. A house alarm will save you money on your homeowners insurance policy (which is generally mandatory if you own a home). In fact, on average installing a home alarm system will give homeowners a 10-20% discount on their insurance by having a high functioning home alarm system installed. The good news is that these home alarm companies are pretty desperate for customers at the moment so you can get a good deal. For instance, one of the best alarm system companies – ADT is currently offering over $850 in free equipment plus a $100 Visa gift card.

It’s also really important seniors have a high functioning alarm system installed so that they can get medical aid in the case of a life threatening emergency, especially for those who live alone.

10. Go Shopping

Banana Republic, Kohl’s, Marshall’s and Stein Mart

You might be surprised to learn that a lot of trendy shops give a senior citizens discount. At Banana Republic, if you over 50-years old you can get a 10% discount at stores, simply by asking for it.

At Kohl’s on Wednesdays, over 60s can get 15% off. And on Tuesdays, outlet stores Marshall’s, Ross will offer up a 10% discount for seniors – though the exact age is determined by each store.

Walgreens hold a “Seniors Day” once a month too – which varies by location. Discounts of 20% are available for Rewards card members that are over 55 years old in store, and if you’re shopping online you can get a 10% price reduction.

If you are 62 or older, you can get a 10% discount every Tuesday and Wednesday at Dress Barn. And that’s not all, Stein Mart are treating over 55s with their clearance offer. On the first Monday of each month, you can get an extra 20% discount on clearance items. Goodwill gives 10%-20% discounts varying by store.

Just remember to check with the specific store in your area, as discounts might vary and change without notice.

11. Never Get Ripped Off By Mechanics Again with FIXD

Have you ever gone to an auto repair shop for an oil change, only to have the mechanic say you need a new transmission? Or has the mysterious “check engine” light come on, and next thing you know the mechanic has a list of expensive engine parts that need replacing?

Unfortunately, mechanics know taking advantage of people is easy, given their lack of knowledge about car maintenance needs. But there’s a new device you can carry with you in your car to tell you exactly what’s wrong with it. If you own a car built after 1996 then you can use this brilliant new device called FIXD to instantly diagnose any car problems.

This means the next time your “Check Engine Light” happens to come on, you’ll know exactly what the issue is and the Mechanics won’t be able to lie to you!

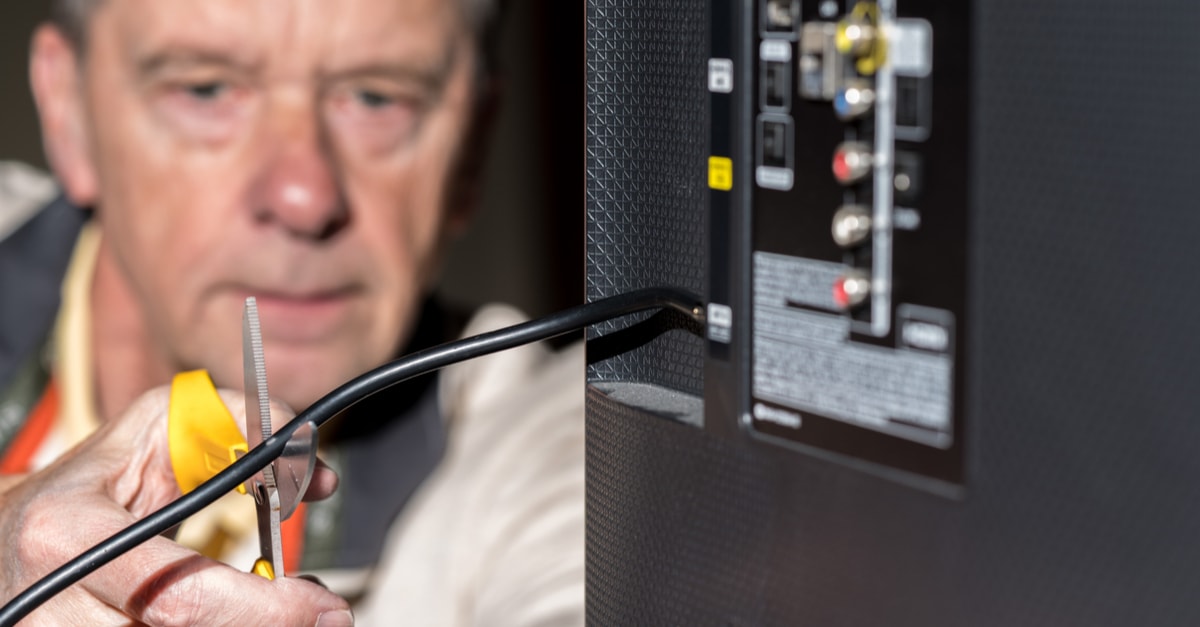

12. Never Pay For Cable Again? This Device Allows You To Watch Your Favorite Channels For Free

Stop wasting your hard-earned money on ridiculous subscription fees. You can enjoy your favorite TV channels and shows (such as ABC, CBS, Fox, NBC, PBS and more) for free! How? It’s very easy. All you need is a powerful indoor TV antenna – SkyLink HD Antenna. It’s suitable for any TV and there are no installation fees, satellite dishes or monthly subscriptions. The best part – it’s absolutely legal. Once you’ll get the TV antenna, it will take you less than 10 seconds to set it up. That’s right. 10 seconds and you can start watching all your favorite shows FOR FREE!

13. Go Solar And Cut Your Energy Bill

Did you know you can significantly reduce your monthly electric bill and pay nothing for it? If you live in a qualified zip code you can get paid to go solar! Thanks to a little-known rebate program called Federal Residential Renewable Energy Tax Credit, homeowners who live in specific zip codes are getting thousands in rebates to install solar panels.

Many people were shocked that subsidies and rebates cover 99% of costs associated with installation so it literally costs $0 to have done. Learn more about this program and check if your zip code qualifies. Senior homeowners can literally save $1,000’s of dollars just by using this program.

14. Relieve Joint Discomfort With This Tip

If you’ve been struggling with joint aches, this offer is just for you. A lot of options don’t give you fast relief, but there’s one revolutionary solution that has saved a nation of seniors: It’s created by a leading Ivy-league doctor and has clinically studied ingredients to soothe joints in as little as 7 days.

It’s called Instaflex Advanced —the #1 joint formula in GNC. Studies show it’s 2x stronger than “chondroitin + glucosamine HCl” and delivers increasing benefits over 90 days of use. (Instaflex also needs only one tiny capsule a day; no more mountains of horse pills.)

Right now, you can claim a 14-day sample of this top-selling formula. We strongly recommend taking advantage of this exclusive online-only offer so you can enjoy much more comfort and flexibility in your joints for a more active life.

15. Hotel Rooms

If you want to settle down for the night someplace away from home you can be sure to get a discount at Marriott, Comfort Inn, Motel 6 and more.

Keep in mind that discounts may vary and change without notice.

■ Marriott – 15% discount (62+). You can book online or call and ask for the senior discount

■ Red Roof Inn – option of “senior rate” when you book online, may not be available for all locations

■ Choice Hotels – 10% discount if you book in advance (60+)

■ Hyatt Hotels – up to 50% off in participating locations. To qualify for this deal you have to make a reservation in advance and book for two people (60+)

■ La Quinta – varying offers at participating locations (65+). Book online or call and ask for senior discounts

■ Omni Hotels – varying offers at participating locations (55+)

■ Motel 6 – 10% discount (60+). Call and book over the phone in order to get discount

■ Wyndham Hotels – varying offers at participating locations (60+)

■ Hampton Inns & Suites – 10% off when booked 72 hours in advance

16. Save on Groceries

Once you’ve used your senior discount at all of your favorite restaurants, you’ll need to buy some groceries. Lots of stores give a senior discount – you just need to ask.

Keep in mind that discounts and deals may vary and can change without notice.

■ Farm Fresh – 5% discount Tuesdays and Thursdays (55+)

■ Hy-Vee – depending on location will usually offer 5% discount on Tuesdays and Wednesdays (some stores set age to 65+)

■ Fred Meyer – 10% senior discount on the first Tuesday of every month

■ New Seasons Market – 10% discount every Wednesday

■ Compare Food Supermarket – 10% discount in participating locations, get in touch with your local store to find out more

■ Piggly Wiggly – varying discounts at participating locations

■ Fry’s Food – 10% discount on the first Wednesday of every month to all seniors with VIP card.

17. Breathe Easy with Portable Oxygen

We all know that without breath, life stops. Your lungs may not be what they used to be, but guess what?

Technology is on your side.

With the INOGEN ONE portable oxygen system, oxygen is as accessible as it always was; and breathing is no more of a daily hassle than purely an afterthought. Most oxygen tanks must be lugged around, and they often weigh as much as an adult female. Not the INOGEN ONE. This sleek, lightweight device weighs a mere 2.8 lbs!

Still not convinced that this device wins out over traditional oxygen tanks?

For a limited time, you can take advantage of an incredible offer for senior: a free kit from the manufacturer! Don’t let your life stop just because your breathing is getting difficult. Do yourself a favor. Click the link below, and breathe easy.

18. Get A Reverse Mortgage

Now although a reverse mortgage is available to older homeowners, it’s still a loan and should be looked at as such. Reverse mortgages allow elders to access the home equity they have built up in their homes now, and defer payment of the loan until they die, sell, or move out of the home. Because there are no required mortgage payments on a reverse mortgage, the interest is added to the loan balance each month. This could be a great option for you if you have a lot of home equity built up, but need some extra money to live during your retirement years. Many retirees have worked hard all their lives and have most of their money tied up in their homes but don’t want to sell because they enjoy the area they live in. That’s where a reverse mortgage can be particularly useful. You can visit Lending Tree to learn more information.

19. Save Money on a New Roof

Paying for a new roof can be an expensive inconvenience for senior homeowners, but it’s something that can cost three to five times more money in years to come. If your roof becomes damaged by leaks or poor insulation, it’s necessary to have it repaired or replaced. If you think your roof might be damaged, visit this website to get quotes from trusted roofing experts in your area.

20. Seniors Save Big on New Windows

Did you know that you can save up to a whopping 40% on your energy costs each month…simply by installing new windows? It may seem odd, but it’s true! Original windows in older homes tend to let out drafts, which contribute to much higher utility costs than the homeowner realizes. Oftentimes, by replacing the old windows with modern versions, the costs to run the A/C and heat drop substantially, and the windows pay for themselves!

And here’s something even better: for a short time, senior citizens can save hundreds of dollars on brand new windows from top manufacturers. Visit the link below and you’ll receive free quotes from the best roofing experts in your area. All you have to do is pick which one has the price you like most and wait for your scheduled appointment!

21. Treat Yourself to a Meal—For Less

Did you realize that even if you don’t feel like cooking, you can get a discount for going to a restaurant? Many national chains offer 10% to 15% off to seniors, or small incentives like a free drink or meal upgrade. Like many others on this list, your best bet is going to be to ask once it’s time to pay.

If you’re in a mom and pop establishment, you may also have some luck as well. Do yourself a favor and always ask your server or cashier about the discounts they offer; you never know when you can save yourself a few dollars here and there

22. High Returns and No Market Risk for Seniors

For decades, saving was your main goal: make sure to put away enough so that you can support yourself in your golden years.

If you’re 55 years of age or older, the time is now to take a look at your finances and prepare. Liquid savings are a crucial start, but they can only get you so far after you retire.

The best way to stretch your dollar?

Annuities. With a variety of investments to choose from, you can be sure that your nest egg is secure as it grows, but also tax-deferred.

Do your finances a favor. Click the link below to check whether an annuity is right for you.

Bonus #1. Seniors Rush To Get Their “Off The Books” Retirement Income

This might be the most important thing you see on the internet all year.

Most seniors have never heard of this, but according to a very large financial publishing company, with a well funded investment you could collect up to $11,334 per month thanks to this “off-the-books” retirement income source that pays retired congressmen and government insiders millions each year…

Financial expert Teeka Tiwari reveals how the wealthy “insiders” have been collecting these checks for years in this new video presentation. Click here to watch now.

Bonus #2. Make Your Bathroom a Spa…For Less!

Let’s face it: having that hot bath isn’t quite as relaxing as it used to be. What was once a haven of luxury and repose is now made difficult and strained thanks to aching muscles and a screaming back—the very ailments you’re more than likely trying to soothe!

Is there any relief in sight?

Look no further, because we’ve got just the remedy for you: a bathtub tailor-made for seniors. With the Dual Hydro-Jet Therapy System, you can say goodbye to your aches, your pains, and your worries—all from the comfort of your own bathroom.

Ready to learn more? Do yourself (and your body) a favor and click the link below to receive FREE quotes on walk-in bathtubs.