There are many special discounts that are available to seniors. Retirees are offered discounts at most retailers, restaurants, parks, on public transport and at hotels. However, you won’t get these discounts unless YOU ASK for them in person or over the phone.

But what about senior discounts online? We realized that seniors had no way of knowing about the online discounts available to them and compiled a list of the 22 best discounts available. Not only can you read about them here, you can click the links provided if you want to take advantage of these special discounts

1. Get Up to $4,264/year Off Your Mortgage

If you’re a homeowner born before 1985 and you want to save yourself thousands of dollars this year, there’s a government program that you might be able to take advantage of called HARP. The Home Affordable Refinance Plan (HARP) is helping hundreds of thousands of Americans reduce their monthly payments by as much as $3,500 in their first year. The program was set to expire in 2017, but has been recently extended through 2018. In order to qualify for HARP you’ll need good credit, so if you don’t have a good credit rating then this probably isn’t for you. If lowering your payments, paying off your mortgage faster, and having an extra $290 a month in HARP savings would help you, then this could be the easiest money savings tip you take.

2. Get a Lower Auto Insurance Rate

You might think you’re already paying a low auto insurance rate, but recent research shows that only 5% of Americans over the age of 55 are paying less than $50 per month for car insurance. If you’re currently paying more than $50 per month, and have had no accidents or tickets in the past two years, you can probably secure a much lower car insurance rate. The best way to do that is to compare quotes from multiple insurers – let them compete for your business. In fact, there’s a new website that allows you to do just that – it’s called Best Quotes Auto Savings. Once you fill out the form on their website they’ll provide you with multiple quotes you can choose from. If you’re still not satisfied, you can always call up the major car insurance companies and let them know you’re looking for better offers and that you’re a senior citizen.

3. Get A Stair Lift At A Big Discount

At a certain point, many older adults (and sometimes younger people) lose the ability to walk up and down stairs. Mobility problems can stem from injury, weakness in the legs, loss of balance, poor eyesight and other conditions. For people who live in homes with more than one story, not being able to use the stairs can make aging in place difficult or even dangerous.

Fortunately, there’s a solution for this problem. A StairLift is an essential piece of medical equipment for a person who needs help walking up or down their stairs at home. Usually a StairLift consists of a mechanized chair that attaches to a staircase and transports the patient or resident up or down as needed, and they’re a boon to adults who have the ability to walk independently but can’t safely navigate steps. If you think it’s time you get a quality stairlift installed in your home and reclaim your independence, then the Easy Climber StairLift is one of the top ones currently on the market.

4. Consolidate All Your Existing Debt Into One Simple Payment

Stepping into retirement can be pretty daunting. Doing it with existing unsecured debts can make it even more of a challenge. Debt Settlement allows you to combine all your unsecured debts into a single monthly payment. Generally this allows for much lower payments on a monthly basis than the sum total of the separate debts – making life a lot more manageable. There are many firms out there who will walk you through the process making it simple and painless. If you have more than $20,000 in debt then this is something you should do right away, especially if you have credit card debt. You can get the best quote to settle all your unsecured debt by clicking the link below.

5. Never Pay For Home Repairs Out-of-Pocket Again

Many people simply don’t have enough money lying around to pay for expensive home repairs. Your home insurance won’t cover your washing machine or AC breaking. What if your heater breaks when you need it the most? How many people have hundreds, or in some cases thousands, of expendable dollars to spend at a moment’s notice for a big repair?

This is why many homeowners are getting this new Home Warranty Program and they’re ending up saving thousands in the long run. ACs, electrical heaters, appliances, roofing repairs – they’re all covered! If there’s something they can’t fix they will just replace it.

6. Born Before 1965? Claim Your Free 72 Hour Survival Food Kit

This special promotion is currently available to anyone born before 1965. With floods, tornadoes, and other natural disasters on the rise, Lindon decided that they wanted every senior citizen to have access to their survival food kits. That’s why they currently have a special promotion for American citizens to get a free 72 hour survival food kit (just pay the S&H fee).

They source most of their raw ingredients from the “fresh produce” category – picture the delicious veggies you find in season at your local farmer’s market. No harmful chemicals, no GMOs and no added MSG.

They also combine their top-quality ingredients using prize-winning recipes so that they’re loaded with flavor. Many of their recipes have won independent taste tests. We recommend giving them a try and taking advantage of this special offer.

7. Save on Life Insurance

Unfortunately, as our age increases so do our premiums for life insurance. In fact, typically the premium amount rises 8-10% for every year of age. For senior citizens, rising life insurance policy costs can add up significantly.

Many senior citizens also have a hard time qualifying for a new policy once they reach a certain age. The best way to get the cheapest life insurance policy possible is to compare quotes from multiple carriers the same way you would do with car insurance or cell phone plans. National Family is a great resource to use for just that. They will automatically use your information to find you the best life insurance policy for your needs at much lower prices.

8. Seniors Rush To The Single Stock Retirement Plan

Not a lot of baby boomers know about this, but Alexander Green the Chief Investment Strategist at the Oxford Club has just released a detailed video which explains how many Americans are now retiring on a single stock. He’ll explain how a modest investment in a $3 stock could generate a multi-million dollar dream retirement in the coming years. If you’re interested in finding out more about this, we recommend you watch his video before the upcoming announcement on October 15th.

9. ADT Offers Seniors An $850+ Discount On A Home Security System

This money saving idea is also for senior homeowners, so if you’re a renter you can skip this one. Did you know that homes without security systems are 2.5 times more likely to be targeted by burglars and intruders? But installing a home alarm system isn’t just to stop burglars and intruders, it can also save you big money year after year. A house alarm will save you money on your homeowners insurance policy (which is generally mandatory if you own a home). In fact, on average installing a home alarm system will give homeowners a 10-20% discount on their insurance by having a high functioning home alarm system installed. The good news is that these home alarm companies are pretty desperate for customers at the moment so you can get a good deal. For instance, one of the best alarm system companies – ADT is currently offering over $850 in free equipment plus a $100 Visa gift card.

It’s also really important seniors have a high functioning alarm system installed so that they can get medical aid in the case of a life threatening emergency, especially for those who live alone.

10. Fight Inflammation With Fruits And Vegetables

It’s no secret that growing older causes aches and pains. This can be caused by many things, but one of the most common causes is inflammation. According to Dr. Lane Sebring, alkaline-rich foods like tomatoes, apples, kale, and cucumbers can help fight inflammation. However, most people don’t get enough fruits and veggies.

Because of this, Sebring developed Patriot Power Greens, a ready-mixed drink that provides the health benefits of 40 fruits and vegetables, probiotics, and digestive enzymes. Unlike supplements, the Power Greens drink is more easily absorbed by your body and has been found to boost energy and reduce inflammation.

11. Never Get Ripped Off By Mechanics Again with FIXD

Have you ever gone to an auto repair shop for an oil change, only to have the mechanic say you need a new transmission? Or has the mysterious “check engine” light come on, and next thing you know the mechanic has a list of expensive engine parts that need replacing?

Unfortunately, mechanics know taking advantage of people is easy, given their lack of knowledge about car maintenance needs. But there’s a new device you can carry with you in your car to tell you exactly what’s wrong with it. If you own a car built after 1996 then you can use this brilliant new device called FIXD to instantly diagnose any car problems.

This means the next time your “Check Engine Light” happens to come on, you’ll know exactly what the issue is and the Mechanics won’t be able to lie to you!

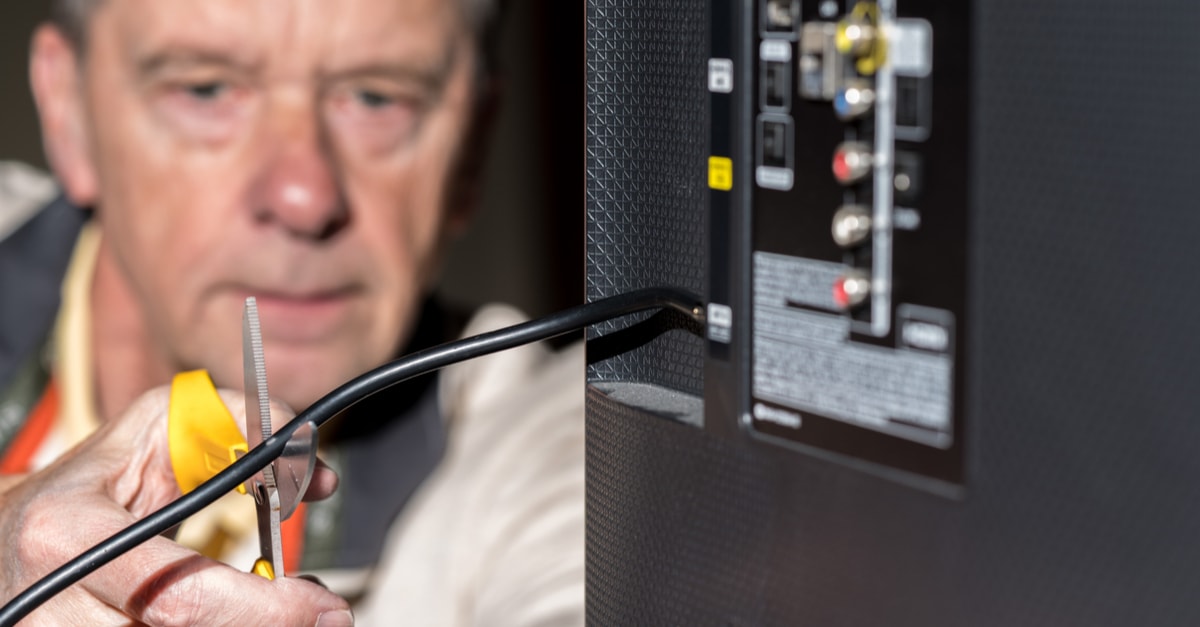

12. Never Pay For Cable Again? This Device Allows You To Watch Your Favorite Channels For Free

Stop wasting your hard-earned money on ridiculous subscription fees. You can enjoy your favorite TV channels and shows (such as ABC, CBS, Fox, NBC, PBS and more) for free! How? It’s very easy. All you need is a powerful indoor TV antenna – SkyLink HD Antenna. It’s suitable for any TV and there are no installation fees, satellite dishes or monthly subscriptions. The best part – it’s absolutely legal. Once you’ll get the TV antenna, it will take you less than 10 seconds to set it up. That’s right. 10 seconds and you can start watching all your favorite shows FOR FREE!

13. Go Solar And Cut Your Energy Bill

Did you know you can significantly reduce your monthly electric bill? If you live in a qualified zip code you can go solar! Thanks to a little-known rebate program, homeowners who live in specific zip codes can get rebates to install solar panels.

Learn more about this program and check if your zip code qualifies. Senior homeowners can literally save $1,000’s of dollars a year just by using this program.

14. Fix Back Pain & Plantar Fasciitis With This Tip

Aging isn’t fun, and a lot of people don’t like to admit their body isn’t quite what it was when they were young. Foot pain, no matter how much or how little it hurts, can cause underlying health issues like back pain, joint pain & plantar fasciitis. That’s why a world renowned orthopedic surgeon is now recommending all senior citizens use these special insoles called Mindinsole.

Taking inspiration from the ancient practice of reflexology, MindInsole will massage your way to better health. The magnetized insoles will stimulate precise pressure points on the soles of your feet to relieve strains, reduce pain, and boost your energy levels.

On each insole, there are 400 accupoints to target key areas of your body. Reduce your back pain and release harmful toxins from your body – MindInsole is just like having a massage therapist wherever you go.

15. Hotel Rooms

If you want to settle down for the night someplace away from home you can be sure to get a discount at Marriott, Comfort Inn, Motel 6 and more.

Keep in mind that discounts may vary and change without notice.

■ Marriott – 15% discount (62+). You can book online or call and ask for the senior discount

■ Red Roof Inn – option of “senior rate” when you book online, may not be available for all locations

■ Choice Hotels – 10% discount if you book in advance (60+)

■ Hyatt Hotels – up to 50% off in participating locations. To qualify for this deal you have to make a reservation in advance and book for two people (60+)

■ La Quinta – varying offers at participating locations (65+). Book online or call and ask for senior discounts

■ Omni Hotels – varying offers at participating locations (55+)

■ Motel 6 – 10% discount (60+). Call and book over the phone in order to get discount

■ Wyndham Hotels – varying offers at participating locations (60+)

■ Hampton Inns & Suites – 10% off when booked 72 hours in advance

16. Save on Groceries

Once you’ve used your senior discount at all of your favorite restaurants, you’ll need to buy some groceries. Lots of stores give a senior discount – you just need to ask.

Keep in mind that discounts and deals may vary and can change without notice.

■ Farm Fresh – 5% discount Tuesdays and Thursdays (55+)

■ Hy-Vee – depending on location will usually offer 5% discount on Tuesdays and Wednesdays (some stores set age to 65+)

■ Fred Meyer – 10% senior discount on the first Tuesday of every month

■ New Seasons Market – 10% discount every Wednesday

■ Compare Food Supermarket – 10% discount in participating locations, get in touch with your local store to find out more

■ Piggly Wiggly – varying discounts at participating locations

■ Fry’s Food – 10% discount on the first Wednesday of every month to all seniors with VIP card.

17. Breathe Easy with Portable Oxygen

We all know that without breath, life stops. Your lungs may not be what they used to be, but guess what?

Technology is on your side.

With the INOGEN ONE portable oxygen system, oxygen is as accessible as it always was; and breathing is no more of a daily hassle than purely an afterthought. Most oxygen tanks must be lugged around, and they often weigh as much as an adult female. Not the INOGEN ONE. This sleek, lightweight device weighs a mere 2.8 lbs!

Still not convinced that this device wins out over traditional oxygen tanks?

For a limited time, you can take advantage of an incredible offer for senior: a free kit from the manufacturer! Don’t let your life stop just because your breathing is getting difficult. Do yourself a favor. Click the link below, and breathe easy.

18. Claim Free Everyday Household Products

Here’s a little tip most retirees aren’t told about. Chances are you purchase the same household products on a daily/weekly basis. But what if you could get free samples sent to you from these very same manufacturers? Not a lot of people know about it, but you can actually claim free samples from top brands. If you’re looking for a way to get household goods, pet food samples, sweet treats, posters, days out vouchers and much more, we recommend signing up for the Free Samples Guide. Once you provide them with your email address, they’ll let you know when you’re eligible for the latest free samples and how to claim them.

19. Save Money on a New Roof

Paying for a new roof can be an expensive inconvenience for senior homeowners, but it’s something that can cost three to five times more money in years to come. If your roof becomes damaged by leaks or poor insulation, it’s necessary to have it repaired or replaced. If you think your roof might be damaged, visit this website to get quotes from trusted roofing experts in your area.

20. Seniors Save Big on New Windows

Did you know that you can save up to a whopping 40% on your energy costs each month…simply by installing new windows? It may seem odd, but it’s true! Original windows in older homes tend to let out drafts, which contribute to much higher utility costs than the homeowner realizes. Oftentimes, by replacing the old windows with modern versions, the costs to run the A/C and heat drop substantially, and the windows pay for themselves!

And here’s something even better: for a short time, senior citizens can save hundreds of dollars on brand new windows from top manufacturers. Visit the link below and you’ll receive free quotes from the best roofing experts in your area. All you have to do is pick which one has the price you like most and wait for your scheduled appointment!

21. Get Thousands Back, Get Rid Of Your Timeshare

If you’re stuck with a Timeshare you never use, let the experts help you get your money back instead of struggling alone. My Timeshare Expert helps you recoup the cost of your Timeshare by providing all the resources you need. Get a free quote with no risk and no obligation through My Timeshare Expert and let the experts tell you how to get thousands of dollars back on your investment. Simply enter your information to get your free quote!

22. Protect Yourself With Long Term Care Insurance

Employer-based health coverage will not pay for daily, extended care services. Medicare will cover a short stay in a nursing home, or a limited amount of at-home care, but only under very strict conditions. To help cover potential long-term care expenses, many seniors choose to buy long-term care insurance. Is it worth getting Long Term Care Insurance? This is something that you really have to decide for yourself…don’t let anyone pressure you into buying it if you feel it’s not worth your money. On the other hand, the cost of staying in an assisted living facility averages out to $43,356 per year in the United States. As you can see, the costs of covering long term care on your own can often times deplete your retirement savings fast. That’s where having long term care insurance can be a very useful thing to have as many basic policies will cover up to $164,000 in benefits. You can get a personal quote for long term care insurance by clicking here.

Bonus #1. Seniors Rush To Get Their “Off The Books” Retirement Income

This might be the most important thing you see on the internet all year.

Most seniors have never heard of this, but according to a very large financial publishing company, with a well funded investment you could collect up to $11,334 per month thanks to this “off-the-books” retirement income source that pays retired congressmen and government insiders millions each year…

Financial expert Teeka Tiwari reveals how the wealthy “insiders” have been collecting these checks for years in this new video presentation. Click here to watch now.

Bonus #2. NightSight Driving Glasses

Seriously, did you know that the vast majority of car accidents happen at night and right before dawn? A lot of that has to do with glare and the problems with vision many people experience. Maybe that’s the reason these driving glasses are selling at a big discount for seniors over the age of 55. Night Sight HD promises to reduce night driving glare and eye strain, and it will dramatically improve seeing at night during snow or rainy conditions.

It lets you see enhanced colour, is durable, lightweight and is fully equipped with polarized lenses. Unlike clip-ons it protects your eyes from all sides, and you can just slide it over your existing prescription lenses. Whether driving, reading or golfing, these versatile goggles make seeing a whole new experience.